Better Information, Smarter Trades

Structured insights on opportunity, odds, and risk.

Markets are Noisy. Data is Overwhelming.

Markets move on economic events, earnings, and macro shifts—but finding clear, structured insights in all the noise? That’s the hard part.

Traders sift through scattered data, conflicting signals, and surface-level charts—trying to piece together a reliable trade idea.

MesoTrader changes that.

Technology Should Work for the Trader.

Most platforms provide generic event calendars and basic indicators, leaving traders to manually filter and interpret market reactions.

We take a different approach.

Our event-driven analytics framework aggregates, filters, and structures market data to highlight what actually matters. Instead of guessing, traders get a clear, contextual view of how markets and individual stocks react to key events over time.

Opportunity, Odds, and Risk Management.

MesoTrader synthesizes key market data surrounding events and identifies repeatable patterns. Market reactions are contextualized across macro and micro trends, providing actionable insights grounded in a structured, data-driven approach—one that accounts for market dynamics, statistical probabilities, and real-world risk considerations.

Whether it's earnings reactions, macro events, or sector trends, MesoTrader helps traders make decisions with clarity and confidence.

FAQ

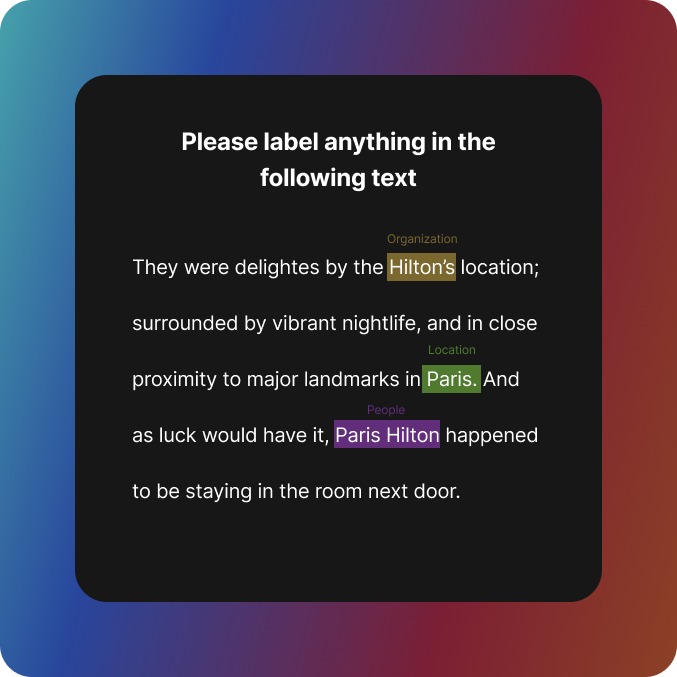

Interested in Rapid labels for your model?

Sign up and request a demo for the fastest way to production-quality labeled data

DatAI

Product

Overview

Business Account

Credit card

Reports

Analytics

Team management

Integrations

Company

About Datai

Contact

Careers

Blog

Press

Copyright © 2022 Datai, Inc. All rights reserved.

Credit & Resources :

Logo : Logoipsum